What’s happening?

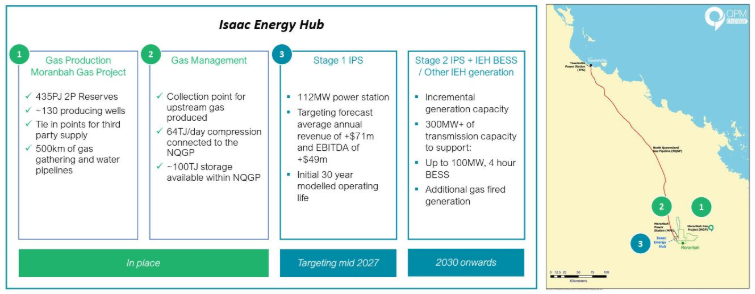

Queensland Pacific Metals Energy has taken a major step toward funding its 112MW Isaac Power Station. The company has completed a $30.3 million Placement at $0.035 per share to institutional and sophisticated investors. The offer was oversubscribed and backed by both existing and new investors.

Funds raised will allow QPM to order critical long lead items including transformers. This helps keep the Isaac Power Station on track for a mid 2027 commissioning.

QPM has also entered a non binding term sheet with an Australian investment company for a $40 million convertible note. Key terms match market precedent transactions. The investor has an eight week exclusivity period to finalise the deal. The investor also subscribed for $2 million of Placement shares.

QPM says these steps establish a clear funding pathway that includes a $180 million joint project finance facility from Macquarie and the Northern Australia Infrastructure Facility. The existing $113.7 million Macquarie Master Lease Agreement will roll into the project finance facility.

QPM Energy Limited is listed on the ASX and says it has advanced the final stages of funding required to develop the 112MW Isaac Power Station.

Why it matters?

These transactions support QPM’s plan to deliver the Isaac Power Station and secure full project funding. The funding mix supports pre construction work, approvals, grid connection steps and wider financial progress.

Local Impact

QPM operates from Brisbane and Townsville. The Isaac Power Station will support QPM’s Townsville Energy Chemicals Hub project located 40km south of Townsville. QPM shareholders include LG Energy Solution, POSCO and General Motors. QPM holds binding offtake agreements with all three partners for nickel and cobalt.

By the numbers

• The Placement price of $0.035 reflects a 12.5 percent discount to the 28 November 2025 closing price, a 7.9 percent discount to the 5 day VWAP and a 7.2 percent discount to the 15 day VWAP.

• Tranche 1 will issue about 747.34 million shares under Listing Rules 7.1 and 7.1A. Tranche 2 will issue about 119.25 million shares, subject to shareholder approval at an Extraordinary General Meeting.

• Total IPS funding sources reach $268 million, which includes $18 million already invested, $180 million in project finance, $40 million from the proposed convertible note and $30 million from the Placement.

• IPS funding uses include $10 million for the GE Vernova turbine deposit, $8 million in feasibility and development costs, $198 million in capital works, $10 million contingency and $42 million for financing costs, fees and working capital.

• Macquarie will receive 25 million options with a $0.06 exercise price and a 24 month term as part of the Master Lease Agreement establishment fee.

Zoom In

QPM can now progress detailed steps for the Isaac Power Station. The Placement was completed through two tranches.

-Tranche 1 shares will be issued using existing capacity under Listing Rules 7.1 and 7.1A.

-Tranche 2 shares will be issued after approval at an Extraordinary General Meeting.

-Non Executive Chairman Eddie King subscribed for $70,000 of shares, which also require EGM approval.

All Placement shares will rank equally with existing shares; Bell Potter Securities, Foster Stockbroking and Ord Minnett acted as joint lead managers and bookrunners.

Funds raised will support long lead item purchases, pre-construction activities, liquidity for final funding steps, IPS financing costs including the Macquarie facility, and general working capital.

QPM CEO David Wrench said the support has been crucial.

“We are very pleased with the strong support from existing shareholders and new investors who participated in the Placement. We have also been working hard to identify an investor who is aligned with the Company’s unique portfolio of assets and growth opportunities. The Potential Note Investor we have signed the non-binding convertible note term sheet with meets this criteria and is well placed to help us accelerate the development of our business through IPS and beyond.”

The proposed convertible note remains subject to multiple conditions. These include expert reports, investor approvals, IPS project approvals including grid connection, project finance finalisation and standard documentation steps.

The investor is an ASX listed company with available capital above $40 million and energy sector experience. The investor requested confidentiality and will be identified if binding documents are executed. QPM says there is no certainty the agreement will proceed.

Zoom Out

QPM has released a full breakdown of IPS funding sources and uses. Total funding of $268 million supports the turbine deposit, feasibility work, capital build, escalation, financing costs and working capital.

QPM is working through NAIF due diligence. Independent technical reports have been completed. The company aims for project finance contractual close by the end of the March 2026 quarter.

Two conditions must be met before funds can be drawn from the project finance facility and the proposed convertible note. These are IPS development approvals and a connection and access agreement with Powerlink Queensland for the Moranbah Substation. QPM says strong progress is being made on both.

Macquarie will receive 25 million options with a $0.06 exercise price and a 24-month term as part of the MLA establishment fee.

QPM has also set an indicative timetable for the Placement, including settlement dates, meeting notices and the targeted January 2026 EGM.

What to look for next?

QPM will work to finalise convertible note documents, complete NAIF due diligence, secure IPS approvals and confirm the grid connection agreement with Powerlink.

The EGM will decide on Tranche 2 shares. QPM aims to complete project finance close by the March 2026 quarter.